Psychology

- Details

- Written by: Admin Site

- Category: Psychology

- Hits: 841

Recently, a post in a trader prop trading group raised concerns about an individual seeking a partner for trading. The person claims to have trading experience since 2016 and offers a property as collateral to potential investors. However, their previous partner allegedly took off with the profits.

Key Red Flags to Consider:

- Unclear Offer & Poor Presentation – The proposal lacks structure and professionalism, making it less trustworthy.

- Collateral in Trading is Unusual – Legitimate prop trading firms do not require real estate or asset collateral; they provide funding instead.

- History of Missing Funds – The claim that a previous partner ran away with money raises concerns about risk management.

- No Verifiable Trading Records – Without proper audit trails or trading statements, the profit claims are questionable.

Final Thoughts:

Before engaging in such offers, ensure that:

✅ All agreements are legally documented and verified by a lawyer.

✅ There is proof of consistent trading success through verifiable statements.

✅ The risk of losing your investment is clearly understood.

If an investment seems too good to be true, proceed with extreme caution. Always verify details before committing your funds.

- Details

- Written by: Admin Site

- Category: Psychology

- Hits: 2001

Case Summary:

A coordinated scam operation involving two individuals, identified as Is, has been uncovered, targeting inexperienced traders under the guise of managing a Forex fund. The perpetrators employ a tag-teaming approach to ensnare victims, initiating contact with promises of professional fund management services. Through a series of deceptive tactics, including false interviews, fabricated affiliations, and relentless demands for additional payments, they exploit the trust and financial vulnerability of unsuspecting victims, resulting in substantial financial losses.

Chronological Account:

1. Deceptive Interview and Deposit Solicitation: Initially, the perpetrators engage victims in discussions about trading strategies, feigning interest in assessing their viability for fund management. Subsequently, they abruptly transition to soliciting deposit fees to be wired to a designated bank account, claiming these funds will facilitate a $10,000 deposit on a MetaTrader platform for management purposes.

2. Zoom Meeting Charade and Fictitious Affiliations: To bolster credibility and entice victims, the fraudsters organize Zoom meetings where they boast about affiliations with a reputable brokerage. False claims of receiving promotional rewards, such as a Mustang car, from the brokerage further perpetuate the illusion of legitimacy. Additionally, they introduce a supposed investor, masquerading as a businessman from Brunei, to lend credence to their scheme.

3. Demand for Additional Payments: Upon receipt of the initial deposit, the perpetrators escalate their deception by demanding further payments to cover purported 'wise transfer fees' essential for depositing funds into the designated account. Despite promising access to a $10,000 investor login, they persistently pressure victims for more money, exploiting their trust and financial naivety.

4. Unfulfilled Promises and Evasion Tactics: Victims who seek concessions, such as reduced fees, are met with temporary appeasement from the fraudsters. However, attempts to secure refunds or clarification on payment status are met with evasion and silence, leaving victims helpless in recovering their losses.

Conclusion:

The fraudulent activities orchestrated by Is represent a calculated exploitation of unsuspecting traders' trust and financial inexperience. Through a combination of deceitful tactics, false affiliations, and relentless demands for additional payments, they have systematically defrauded victims of substantial sums of money. Urgent intervention by law enforcement authorities is necessary to apprehend these perpetrators and prevent further harm to innocent investors.

---

- Details

- Written by: Admin Site

- Category: Psychology

- Hits: 3060

In a series of 25 trades with a 50-50 win rate, each trade is independent of the others. The probability of losing any individual trade is 0.5 (50%), and the probability of winning is also 0.5.

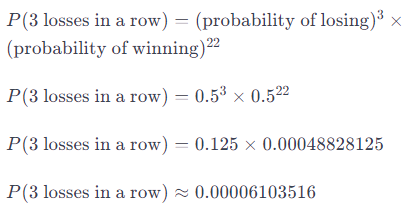

To calculate the probability of a specific sequence of outcomes, you can use the binomial probability formula. For a losing streak of 3 trades in a row:

So, there's approximately a 0.0061% chance of experiencing a 3-loss streak in a series of 25 trades with a 50-50 win rate. Each trade's outcome doesn't affect the others, but the probability of a specific sequence depends on the individual probabilities of each outcome.

- Details

- Written by: Admin Site

- Category: Psychology

- Hits: 780

Pros:

-

Leverage: Using loaned money allows you to trade with more capital than you actually have. This can amplify your potential profits if the trades go in your favor.

-

Opportunity for Higher Returns: With increased capital, there's a potential for higher returns on successful trades.

-

Diversification: You can diversify your portfolio more easily with a larger amount of capital, spreading risk across different assets.

Cons:

-

Increased Risk: The use of borrowed funds magnifies both gains and losses. If the market moves against you, your losses will be more significant than if you were trading with your own money.

-

Interest Costs: Personal loans typically come with interest rates, and you'll need to pay back the loan regardless of your trading success. If your returns don't cover the interest, you could end up with a net loss.

-

Market Volatility: CFD trading is already a high-risk activity, and using borrowed money adds another layer of risk. Market volatility can lead to rapid and unexpected losses.

-

Pressure to Repay: There's a psychological aspect to trading with borrowed money—you might feel pressured to make risky moves to quickly repay the loan, leading to impulsive decisions.

-

Uncertain Returns: The market is unpredictable, and there are no guarantees of profit. Using borrowed money can expose you to financial difficulties if the trades don't go as planned.

In summary, while trading with borrowed money can provide opportunities for higher returns, it significantly increases the level of risk. It's essential to thoroughly understand the risks involved and have a well-thought-out strategy before using borrowed funds for trading. Additionally, consider consulting with a financial advisor to assess the suitability of such a strategy based on your financial situation and risk tolerance.